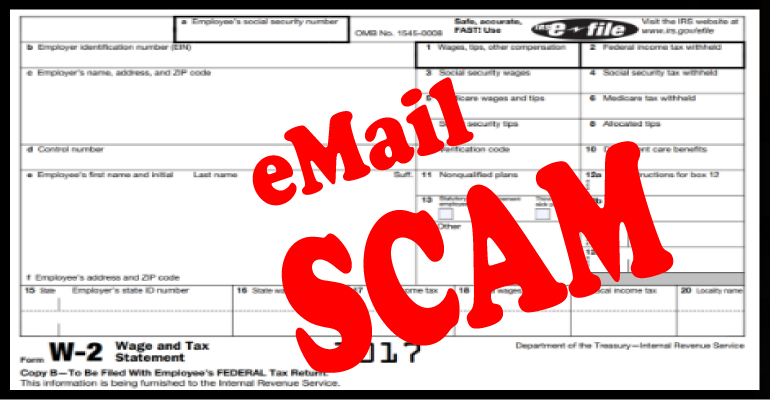

W-2 SCAMS PICKING UP AS TAX SEASON NEARS

As tax season is right around the corner the IRS is warning small businesses should be on-guard against a growing wave of identity theft and W-2 scams. Cyber-criminals tricked payroll personnel or people with access to payroll information into disclosing sensitive information for entire work-forces.

What is a W-2? … W-2’s are those essential forms you include when you file your taxes. They contain information such as your name, address, Social Security number, income, and tax withholding’s.

Employers engaged in a trade or business who pay remuneration for services performed by an employee must file a Form W-2 for each employee who had

- Income, Social Security, or Medicare taxes withheld

- Non-cash payments of $600 or more for the year

- Non-cash payments of any amount if any income, social security, or Medicare tax was withheld

How the scam works. Cyber-criminals do their homework, checking to find chief operating officers, school executives or others in positions of authority in a business. Using a technique known as business email compromise (BEC) or business email spoofing (BES), then they send an e-mail to payroll personnel posing as the executive requesting copies of Forms W-2 for all employees.

What to do?

- Be alert and aware of strange requests

- If your company falls victim report it to the IRS immediately at [email protected]

- Employees whose information has been stolen should follow steps recommended by FTC and report it at Identity Protection.

In a world today where Identity theft and cyber-criminals are on the rise, the importance of training your staff on how to handle sensitive information and what to do if there is a possible issue is essential.